Import costs sometimes feel like a maze, especially for DTH drill bits. My own experience shows that accuracy in this process is very important. Accurate calculations help with proper budgeting and purchasing. Let's make it simple!

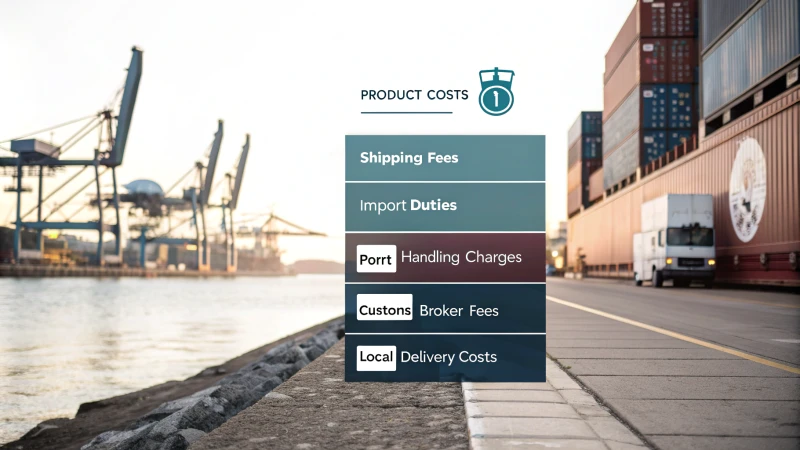

Calculate import costs for DTH drill bits by starting with the Ex-Factory or FOB price. Add shipping and freight costs next. Then include import duties and taxes. Port handling charges follow. Customs broker fees come after that. Finally, consider local delivery expenses. Each factor is very important. These elements determine your total landed cost. Every detail is crucial.

When I began importing DTH bits, all the hidden costs really surprised me. I had to experiment and lose some sleep to grasp the complete picture. I examined each part closely. I realized that knowing the Ex-Factory or FOB price, shipping fees, import duties and local delivery costs is crucial. Each component adds to the total cost. Understanding these details helps avoid surprise expenses in the future.

DTH drill bits import costs include shipping fees.True

Shipping fees are a crucial part of calculating total import costs for DTH drill bits.

Import duties are not necessary for calculating costs.False

Import duties must be considered when calculating the total landed cost of imported goods.

What Are the Key Components of Import Costs?

Import costs often seem overwhelming. They don't have to be. Essential components contribute to these expenses. Understanding them empowers your business decisions.

Import costs involve several essential parts꞉ product costs (ex-factory or FOB prices), shipping and freight costs, import duties and taxes, port handling charges, customs broker fees and local delivery expenses. Knowing these details is very important for good budgeting. Financial planning requires this understanding.

When I started handling import costs, I felt like I was entering a maze without a map. Every turn brought new fees and expenses I never saw before. As I broke down the costs, I saw that understanding each part was really important for budgeting. Let's explore this together.

1. Product Cost (Ex-Factory or FOB Price)

The product cost is usually the biggest part of your import expenses. This is what you pay to the manufacturer for the goods. It might seem tricky, so let's simplify:

| Term | Description |

|---|---|

| Ex-Factory Price | Price at the manufacturer’s facility, excluding transport or additional costs. |

| FOB Price | Includes the cost of goods and delivery to the port of shipment, where the seller bears costs until the goods are loaded. |

Understanding these terms is vital for budgeting and negotiating prices with suppliers. For detailed insights on pricing strategies, you can explore pricing tactics1.

Check out shipping solutions2 if you want to explore more options.

2. Import Duties and Taxes

Import duties and taxes can seem like a foreign language because they change by country. Here are some usual charges:

- Customs Duty: A percentage of your invoice value that customs authorities charge.

- Value Added Tax (VAT): An extra tax on imports based on their total value plus customs duties.

- Local Taxes: There might be extra taxes depending on your location.

Here’s a simple table summarizing common duty rates:

| Country | Customs Duty Rate | VAT Rate |

|---|---|---|

| USA | 2.5% | 0% |

| EU Countries | 5-12% | 20% |

| Canada | 5% | 5% |

For more details on specific countries, see import duty resources3.

3. Port Handling Charges

These fees apply when shipments reach the port:

- Unloading and Handling Fees: Costs for unloading goods and moving them to a warehouse.

- Storage Fees: These increase if customs clearance takes too long.

- Customs Clearance Fees: Payments to brokers for handling customs processing.

To understand these fees better, see port fee breakdowns4.

4. Customs Broker Fees

Customs brokers help navigate import regulations. Their fees usually include:

- Documentation Fees: Costs for needed customs declarations.

- Service Charges: Charges for their customs compliance expertise.

Here’s an average cost summary:

| Fee Type | Estimated Cost |

|---|---|

| Documentation Fee | $100 - $300 |

| Service Charge | $50 - $200 |

For tips on choosing a good broker, look at customs brokerage tips5.

5. Local Delivery and Distribution Costs

After clearing customs, think about:

- Inland Freight: Payments to transport goods from the port to your location.

- Warehousing: Costs if you store inventory before distribution.

Here’s a quick summary:

| Cost Component | Description |

|---|---|

| Inland Freight | Charges for local transportation post-import. |

| Warehousing | Fees for storing goods before they are sold or used. |

in effective local logistics management, refer to distribution strategies6.

Product cost is the primary component of import expenses.True

The product cost, including ex-factory and FOB prices, is crucial for calculating total import expenses.

Air freight is cheaper than sea freight for shipping goods.False

Air freight is typically more expensive than sea freight due to faster delivery times and higher operational costs.

How Do Shipping Methods Affect Import Expenses?

Do you ever think about how shipping options influence your import costs? I faced this question when I began importing goods. Let's explore this topic together!

Shipping methods greatly influence import costs. These costs depend on transportation speed, distance and weight. Extra fees like customs duties also play a role. Grasping these elements guides us to choose wisely. Optimizing logistics becomes easier with this knowledge.

Understanding Shipping Methods and Their Costs

Shipping methods play a critical role in determining overall import expenses. Each method comes with its own advantages and disadvantages that can significantly impact costs.

-

Air Freight: When I needed urgent supplies, air freight was the best option. It was the fastest way to get my goods, but it was very expensive. This method is great for valuable items or those that need quick delivery.

- Pros: Fast delivery, lower inventory costs helped my business.

- Cons: High expense, limited cargo capacity made decisions difficult.

-

Sea Freight: For large orders, sea freight worked best for me. It took longer, but the savings were significant. I was relieved when my shipment arrived without high costs.

- Pros: Lower shipping rates suited larger shipments.

- Cons: Longer travel times were sometimes frustrating, especially when I wanted to fulfill customer orders quickly.

Both methods involve distinct cost considerations, and understanding these can help in making informed shipping decisions. For more detailed comparisons on shipping methods, check out shipping logistics7.

Factors Affecting Shipping Costs

The following factors influence the cost of shipping:

| Factor | Impact on Cost |

|---|---|

| Distance | Longer distances increase fuel and handling costs. |

| Weight & Volume | Heavier and bulkier shipments incur higher fees, especially in sea freight. |

| Shipping Insurance | Insuring valuable shipments adds to overall costs. |

| Customs Fees | Different countries impose varying import duties and taxes. |

Each of these elements must be calculated to get an accurate estimate of total import expenses.

Customs Duties and Taxes

Importing goods also involves customs duties and taxes, which are affected by the shipping method used. Different shipping methods may lead to different customs processing times:

- Air freight can expedite customs clearance but may still incur higher duties due to the speed.

- Sea freight might result in lower duties but could take longer for processing.

Understanding these implications can lead to more efficient budgeting. For further insights on customs regulations, visit customs compliance8.

Port Handling Charges

In addition to shipping costs, port handling charges can vary based on the shipping method:

- Air Freight: Airports have higher fees due to strict security measures and faster processing times.

- Sea Freight: Although cheaper, additional costs may arise from longer storage times at ports if clearance is delayed.

Evaluating these charges is crucial when estimating total import expenses. Learn more about handling charges by checking out port operations9.

Final Considerations

When choosing a shipping method, consider not just the initial cost but how each option fits into your overall business strategy and operational needs. The right choice can lead to significant savings and a more efficient import process.

Air freight is always cheaper than sea freight.False

This claim is false; air freight is typically more expensive due to speed and handling costs.

Distance affects shipping costs significantly.True

True; longer distances increase fuel and handling costs, impacting overall shipping expenses.

What Types of Import Duties Should You Be Aware Of?

Understanding import duties feels overwhelming. Trust me, learning about different types saves stress and money. Let me share what I’ve learned!

Understanding different types of import taxes is very important when bringing goods into a country. Customs duty, VAT and excise duties are some of these taxes. These taxes probably affect your total expenses. Knowing them really helps with smart budgeting.

Understanding Import Duties

Import duties are fees imposed by a government on goods brought into the country. They can significantly affect the overall cost of imported products, so it’s vital to understand the various types of duties that may apply.

Types of Import Duties:

-

Customs Duty: A primary form of import duty based on the value of the goods being imported. This is typically calculated as a percentage of the total value of the goods, including shipping costs. For example, if you import drilling equipment valued at $10,000 with a 5% customs duty, you would owe $500 in duties.

-

Value Added Tax (VAT): In many countries, VAT applies to imported goods and is charged in addition to customs duty. This tax is a percentage of the value of the goods plus any customs duties paid. If the VAT rate is 20%, then for the same drilling equipment, the VAT would be calculated on $10,500 (value + duty), resulting in an additional $2,100.

-

Excise Duties: These are specific taxes applied to certain products like alcohol, tobacco, and fuel. Depending on the type of product you import, excise duties could add a significant cost.

Key Factors Influencing Import Duties

Several factors can influence the amount of import duty you might face:

- Country of Origin: Different countries have different duty rates due to trade agreements or tariffs. For instance, importing from countries with Free Trade Agreements (FTAs) may lower or eliminate duties altogether.

- Product Classification: Goods are classified under specific codes known as HS codes (Harmonized System). Each code has a corresponding duty rate. Misclassification can lead to overpayment or legal issues.

- Value of Goods: The higher the declared value of your goods, the higher the duty will be. Accurate valuation is crucial to avoid penalties.

| Factor | Impact on Duties |

|---|---|

| Country of Origin | Varies based on trade agreements |

| Product Classification | Determines applicable rates |

| Value of Goods | Higher value equals higher duties |

Additional Costs Related to Import Duties

When importing goods, consider other associated costs:

- Customs Clearance Fees: These fees are paid to customs brokers for their services in clearing goods through customs. It's common for brokers to charge between $100 and $300 per shipment.

- Storage Fees: If your goods are held at the port for an extended period, storage fees may apply. These can range from $10 to $50 per day depending on the port.

- Inspection Fees: Some shipments may require inspection by customs officials, leading to additional charges that vary based on the nature of the inspection.

Tips for Managing Import Duties

Managing and minimizing import duties requires strategic planning:

- Research Free Trade Agreements: Identify if your country has any FTAs with the exporting country that could reduce or eliminate duties.

- Consult with a Customs Broker: Brokers have expertise in navigating import regulations and can help ensure compliance while potentially saving money on duties.

- Accurate Documentation: Ensure all paperwork is precise, including invoices and HS codes, to avoid delays and fines.

By understanding these elements, you can better navigate the complexities of import duties and avoid unexpected costs when bringing products into your country.

Customs duties are always calculated as a flat fee.False

Customs duties are not flat fees; they are typically calculated as a percentage of the goods' value, including shipping costs.

Value Added Tax applies only to domestic products.False

Value Added Tax (VAT) applies to imported goods in addition to customs duties, not just domestic products.

How Can I Optimize Shipping and Handling Fees?

Shipping and handling fees often seem like a never-ending drain on my profits. But I've learned useful ways to reduce these expenses over time. My service quality stayed the same. I want to share what I’ve discovered!

Understand your cost components to reduce shipping and handling fees. Select the correct shipping methods. Combine shipments where possible. Negotiate with carriers for better rates. Use packaging that saves space and reduces costs. Monitor your performance often. Check it regularly.

Understanding My Costs

To effectively optimize shipping and handling fees, start by understanding the components of your costs.

| Cost Component | Description |

|---|---|

| Product Cost | The base cost of your items, including Ex-Factory and FOB prices. |

| Shipping and Freight Costs | Costs associated with transporting goods, influenced by methods, distance, volume, and weight. |

| Import Duties and Taxes | Customs duties and local taxes that apply to imported goods. |

| Port Handling Charges | Fees incurred at ports for unloading and storing goods. |

| Customs Broker Fees | Charges for services related to customs compliance. |

| Local Delivery Costs | Expenses for transporting goods from ports to final destinations. |

Choosing the Right Shipping Method

Selecting the correct shipping method was crucial as it can significantly impact costs.

- Air Freight: Fast but expensive; ideal for urgent shipments.

- Sea Freight: Cost-effective for large shipments but slow.

- Ground Shipping: Suitable for local deliveries; prices fluctuate significantly.

Consider using shipping rate calculators10 to find the best options based on your needs.

Consolidating Shipments

One valuable tip was consolidating shipments as it reduces overall shipping fees.

- Bulk Ordering: Larger orders less often reduce individual shipment costs.

- Shared Containers: Collaborating with other businesses has reduced our costs with shared shipping containers.

Learn more about consolidation strategies11 for better logistics management.

Negotiating with Carriers

Building strong relationships with carriers has brought better rates:

- Volume Discounts: I request volume discounts when shipping large quantities regularly.

- Loyalty Programs: Many carriers reward loyal customers with lower rates over time.

Explore tips on negotiating shipping rates12 to maximize your savings.

Optimizing Packaging

Reducing package size and weight has cut my shipping costs:

- Use lightweight materials that still provide effective protection for products.

- Designing packaging minimizes wasted space while ensuring safety.

Consider checking packaging optimization techniques13 for further insights.

Monitoring Shipping Performance

Tracking shipping performance has been vital:

- Analytics tools help assess shipping times and costs.

- I identify patterns in delays or increasing costs which allows informed changes.

Check out logistics tracking tools14 to help manage this process effectively.

Understanding cost components is crucial for fee optimization.True

Identifying product costs, shipping, duties, and handling fees helps businesses manage and reduce overall shipping expenses effectively.

Consolidating shipments can significantly reduce shipping fees.True

By ordering in bulk or sharing containers, businesses can lower individual shipment costs, leading to overall savings on logistics.

What Role Does a Customs Broker Play in Importing?

Have you ever felt lost in the world of importing goods? I have too! A customs broker's job is to simplify this process. They turn confusion into clear understanding. They guide you through complex rules. They help transactions go very smoothly.

A customs broker is very important for bringing goods into a country. They handle all needed paperwork. They follow laws and rules. They sort goods for taxes. Most importantly, they really save businesses both time and money.

The Essential Role of Customs Brokers in International Trade

Customs brokers are key players in the importing process, acting as intermediaries between importers and governmental regulatory agencies. They ensure that imported goods comply with all applicable laws and regulations, facilitating smooth cross-border transactions.

Customs brokers are responsible for:

- Documentation: They prepare and submit the necessary paperwork for the import process, including customs declarations and invoices. Proper documentation is crucial to avoid delays or fines. Learn more about customs documentation15.

- Tariff Classification: Brokers determine the correct tariff classification for imported goods, which impacts the duties and taxes owed. Incorrect classification can lead to hefty penalties. Find out how tariffs work16.

- Compliance: They ensure compliance with various import laws, including safety standards and trade regulations. This involves understanding the complexities of local and international trade agreements.

Benefits of Hiring a Customs Broker

Engaging a customs broker can provide several advantages for businesses looking to import goods:

- Expertise: Customs brokers possess specialized knowledge of import regulations and procedures, which can help streamline the importing process.

- Time-Saving: By handling all documentation and regulatory requirements, customs brokers save businesses valuable time, allowing them to focus on their core operations.

- Risk Mitigation: They help minimize the risk of non-compliance by keeping up-to-date with changing laws and regulations, thus protecting businesses from potential fines or penalties.

| Benefit | Description |

|---|---|

| Expertise | In-depth knowledge of customs regulations |

| Time-Saving | Allows businesses to concentrate on their operations |

| Risk Mitigation | Reduces the likelihood of costly penalties |

Customs Broker Fees

While hiring a customs broker incurs fees, these costs can be outweighed by the benefits they provide. Typical fees may include:

- Documentation Fees: Charged for preparing and submitting necessary import paperwork.

- Service Fees: Compensation for their time and expertise in navigating complex customs regulations.

Here's a breakdown of typical customs broker fee structures:

| Fee Type | Estimated Cost |

|---|---|

| Documentation Fees | $50 - $200 per shipment |

| Service Fees | $100 - $300 per hour |

When to Consider Hiring a Customs Broker

Businesses that regularly engage in importing may find it beneficial to hire a customs broker, particularly when:

- Dealing with high volumes of shipments, where managing compliance becomes cumbersome.

- Importing specialized or regulated products that require detailed knowledge of specific laws.

- Entering new markets with unfamiliar regulations and documentation requirements.

In summary, customs brokers play a pivotal role in simplifying the complexities of importing goods. Their expertise not only facilitates compliance with import regulations but also enhances overall operational efficiency for businesses involved in international trade. Discover more about the role of customs brokers17.

Customs brokers ensure compliance with import regulations.True

Customs brokers are essential for navigating complex import laws, ensuring that businesses meet all regulatory requirements to avoid penalties.

Hiring a customs broker is always more expensive than handling imports alone.False

While customs brokers incur fees, their expertise often saves money by preventing costly compliance errors and delays, making them cost-effective in many cases.

How Can I Minimize Local Delivery and Distribution Costs?

Here are practical strategies to reduce local delivery and distribution costs for the business. Logistics need simplification. This change improves profits and delights customers.

I reduce local delivery and distribution costs. I optimize my supply chain to do this. Technology investments are crucial. Better shipping rates result from negotiations. Delivery methods need evaluation. I strategically locate warehouses for efficiency. Performance metrics should be regularly analyzed. These steps are very important. They improve efficiency and cut costs.

1. Optimize My Supply Chain

To minimize local delivery costs, consider optimizing your supply chain. This can involve:

- Supplier Consolidation: Working with fewer suppliers simplifies communication and reduces costs. Bulk shipping with fewer partners is cost-effective.

- Route Planning: Using route planning software maps out efficient delivery paths. This reduces fuel costs noticeably and improves delivery times significantly, benefiting the overall process. Tools like routing optimization software18 can provide detailed insights.

Adopting these strategies will streamline your operations and reduce costs over time.

2. Invest in Technology

Leveraging technology can significantly lower delivery expenses:

- Automated Inventory Management: Automated systems help manage stock levels effectively, preventing overstocking and reducing warehousing costs.

- Delivery Tracking Systems: Real-time tracking of deliveries simplifies logistics management. Implementing delivery tracking allows you to monitor and manage your logistics efficiently. Learn more about logistics technology19 to improve operational efficiency.

These technologies not only save money but enhance customer satisfaction as well.

3. Negotiate Better Shipping Rates

Often, local distributors overlook the power of negotiation:

- Volume Discounts: Using shipment volume to negotiate helps get better rates; asking for discounts on large shipments makes a big financial difference.

- Multiple Carrier Options: Comparing different carriers’ rates often reveals better deals. Analyzing shipping options20 can help you choose the most cost-effective solution.

4. Evaluate My Delivery Methods

Different delivery methods come with varying costs:

| Delivery Method | Cost Implication | Speed |

|---|---|---|

| Standard Shipping | Lowest | 5-7 Days |

| Express Shipping | Higher | 1-2 Days |

| Same-Day Delivery | Highest | Same Day |

Choosing wisely helps budget effectively by balancing urgency and cost.

5. Warehouse Location Strategy

The location of your warehouses can impact distribution costs greatly:

- Strategic Placement: Placing warehouses closer to key markets reduces transport distances, leading to remarkable savings.

- Utilize Third-Party Logistics (3PL): Partnering with 3PL providers helps manage warehousing and delivery without the overhead of maintaining personal facilities. Explore benefits of 3PL21 to understand how this can streamline your operations.

6. Analyze My Delivery Performance

Regularly analyzing delivery metrics can unveil hidden inefficiencies:

- Key Performance Indicators (KPIs): Monitoring metrics like on-time delivery spots areas that need work; tracking KPIs such as on-time delivery rates informs adjustments needed in operations.

- Customer Feedback: Gathering customer opinions on delivery times and service is invaluable; implementing feedback improves processes and cuts costs.

By continuously evaluating performance, businesses can adapt to changing conditions and optimize costs effectively.

Optimizing your supply chain reduces transportation costs.True

Streamlining supplier partnerships and route planning minimizes delivery expenses and enhances efficiency.

Investing in technology eliminates all delivery costs.False

While technology can lower costs, it does not completely eliminate them; some expenses will always remain.

Conclusion

Learn the essential steps to calculate import costs for DTH drill bits, including product pricing, shipping fees, duties, and local delivery expenses.

-

This link provides valuable insights into various shipping methods and their cost implications, which can enhance your understanding of logistics in imports. ↩

-

Learn more about how to calculate customs duties and taxes for your imports, ensuring you budget accurately for your business needs. ↩

-

This resource outlines typical port handling charges and what businesses should expect when importing goods, aiding in better financial planning. ↩

-

Explore tips on hiring customs brokers effectively, ensuring compliance with import regulations while managing costs. ↩

-

Discover strategies for managing local distribution costs effectively after clearing customs, optimizing your supply chain. ↩

-

This link discusses the various local delivery options available and how they affect overall import costs, helping you make informed decisions. ↩

-

Learn how different shipping options can save you money on imports while considering speed and reliability. ↩

-

Get insights into customs regulations that affect your import expenses based on shipping methods. ↩

-

Understand the breakdown of port handling charges based on your chosen shipping method. ↩

-

This link provides valuable insights into reducing shipping costs through effective strategies and techniques that can enhance your logistics operations. ↩

-

Gain insights into consolidating shipments which can lead to significant savings on shipping fees. ↩

-

Learn how to negotiate better rates with carriers, which can result in lower overall shipping expenses. ↩

-

Discover effective packaging strategies that help reduce weight and dimensions, leading to lower shipping costs. ↩

-

Explore tools that help monitor your shipping performance and identify areas for improvement in logistics. ↩

-

Clicking this link will give you access to more detailed insights on customs documentation, an essential aspect of the importing process. ↩

-

This link provides clarity on how tariffs function, which is crucial for understanding the cost implications of imports. ↩

-

This resource explores the various benefits of hiring a customs broker, providing a comprehensive understanding of their value. ↩

-

This link provides insights into effective strategies for improving logistics efficiency and reducing costs, perfect for enhancing your operations. ↩

-

Explore this resource to learn about the latest logistics technologies that can streamline your delivery process and cut costs. ↩

-

Find out how to negotiate better shipping rates and choose the right carriers for your business needs through this link. ↩

-

Learn how third-party logistics can help reduce warehousing and distribution costs while enhancing your service capabilities. ↩