Navigating customs for DTH drill bits can feel like decoding a puzzle without the picture on the box.

The import customs clearance process for DTH drill bits involves preparing key documents like commercial invoices and bills of lading, declaring goods upon arrival, assessing duties and taxes, and potentially undergoing customs inspections before the goods are released.

I remember the first time I had to deal with this process; it felt overwhelming. Each step seemed to come with its own set of challenges, but understanding the details made all the difference. By meticulously preparing documents and staying informed about duty assessments and inspections, I managed to streamline my imports, saving time and avoiding unexpected costs. Diving into the nuances of customs clearance is essential to safeguarding your imports and ensuring everything runs smoothly.

DTH drill bits require a commercial invoice for import clearance.True

Commercial invoices are mandatory for declaring the value and origin of goods.

Customs inspections are always required for DTH drill bits.False

Inspections are potential but not mandatory; they depend on customs assessments.

What Essential Documents Do You Need for Importing DTH Drill Bits?

Ever tried to import DTH drill bits and felt overwhelmed by the paperwork? Trust me, I’ve been there too, navigating through a sea of documents just to get my shipment cleared.

To import DTH drill bits, you'll need essential documents like a commercial invoice, bill of lading or air waybill, packing list, certificate of origin, and possibly an import license. These documents are crucial for clearing customs smoothly and staying compliant.

Key Documents for Importing DTH Drill Bits

So, let me break it down. When I first started importing DTH drill bits, I realized pretty quickly that having the right documents in order is like having a key to unlock smooth transactions. Here's what you need:

-

Commercial Invoice: Think of this as the receipt of your transaction. It’s got all the juicy details about the goods—what they are, how much they're worth, and the terms of the sale. Having a detailed invoice can be a lifesaver by keeping customs delays at bay.

-

Bill of Lading or Air Waybill: This is your contract and receipt all wrapped in one. For those shipments by sea or air, ensuring that this document matches your shipment details can prevent any hiccups along the way.

-

Packing List: Picture this as the table of contents for your shipment. It tells customs exactly what's in each package and helps verify that everything matches up with your other paperwork.

-

Certificate of Origin: This document is like a passport for your goods, indicating where they were manufactured. Sometimes, it can even help you save on tariffs if there are special agreements in place.

| Document Type | Purpose |

|---|---|

| Commercial Invoice | Details transaction and terms of sale |

| Bill of Lading | Contract of carriage and receipt of goods |

| Packing List | Specifies package contents |

| Certificate of Origin | Indicates manufacturing location |

Additional Considerations

And don’t forget, depending on where you're sending those drill bits, you might need an Import License. Some countries are sticklers for this, so check ahead to avoid legal snags.

Also, keep an eye out for any extra certificates like quality or inspection certifications. They might not always be needed, but when they are, they can make a big difference in compliance.

Customs Clearance Process

Once your precious cargo arrives, it’s showtime! I usually get an agent to handle customs declarations electronically; it’s smoother and faster. Knowing local customs regulations1 makes all the difference here.

Duty and Tax Assessment

Be ready for customs to assess duties and taxes based on your drill bits’ value and classification. These rates can vary depending on materials and purposes. That's why I always consult a customs broker2 to navigate these waters and find any possible exemptions.

Inspections and Compliance

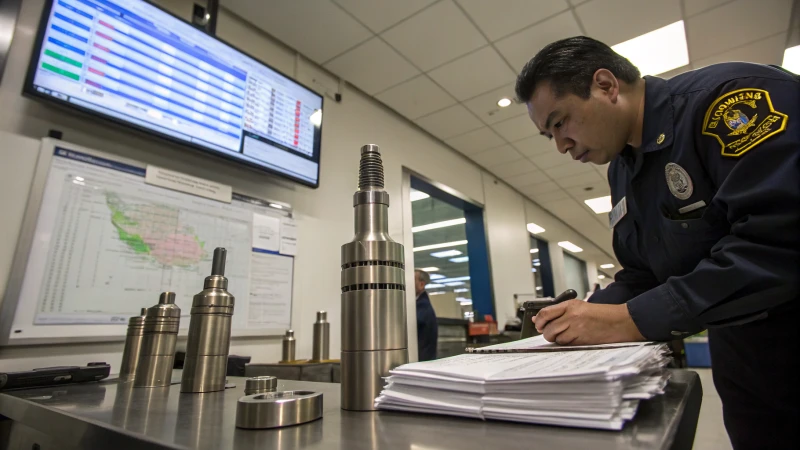

Now, customs might want to take a closer look at what you're bringing in. Especially with specialized equipment like DTH drill bits, making sure all your technical specs and certifications are spot-on is key to avoiding delays.

Getting all these ducks in a row not only saves time but also ensures that your DTH drill bits make it smoothly into international markets, ready for action.

A commercial invoice details transaction specifics for imports.True

It includes descriptions, value, and terms of sale for the goods.

A packing list is unnecessary for customs inspection.False

The packing list specifies package contents, aiding customs verification.

How Do You Declare DTH Drill Bits to Customs Upon Arrival?

Ever been caught in the web of customs paperwork, feeling like you're just a step away from a scene out of a bureaucratic nightmare?

When declaring DTH drill bits at customs, ensure you have all your documentation ready, correctly classify your items, and fill out the customs declaration form meticulously. Staying on top of local rules helps avoid any fines or delays.

Documentation Essentials

I remember the first time I imported a batch of DTH drill bits. I was overwhelmed by the stack of paperwork. But breaking it down, here's what you really need:

- Commercial Invoice: Think of this as your drill bits' birth certificate. It details everything from their value to a description.

- Bill of Lading/Air Waybill: This is your travel ticket for the goods, proving they’re on their way.

- Packing List: A bit like a grocery list but for industrial equipment.

- Certificate of Origin: It's like proving where your drill bits went to school—it's all about their roots.

Import License & Certificates

Depending on where you're shipping to, an import license might be necessary. I learned the hard way that not having the right certifications3 can lead to headaches with customs. Trust me, you don’t want to skip this step.

Customs Declaration Process

Once, I found myself staring at a customs declaration form, completely lost. But once you get the hang of it, it's straightforward. Be specific: describe your DTH drill bits clearly and double-check that HS code. It’s crucial to avoid any hiccups.

Duty and Tax Assessment

There's no escaping duties and taxes—customs will assess them based on your declaration. The right classification can save you money and time.

| Consideration | Details |

|---|---|

| Duty Rates | Vary based on material and purpose |

| Special Concessions | Check for any applicable trade agreements |

Customs Inspection

Imagine your goods getting inspected—it's like an intense game of "spot the difference." Officials ensure everything matches up with your documents, especially for items like DTH drill bits used in mining4.

Payment and Release

Once duties are assessed, prompt payment is key. For businesses like mine, deferred payment options are a lifesaver, speeding up the process so those drill bits can get where they need to be without unnecessary delays.

A commercial invoice is optional for customs.False

A commercial invoice is mandatory to detail transaction value and description.

DTH drill bits require a specific HS code.True

Correct HS code classification determines duties and taxes applicable.

How Do Duty and Tax Assessments for DTH Drill Bits Work?

Navigating the world of duties and taxes for DTH drill bits can feel like a maze. I've been there, trying to make sense of how product classification and trade agreements impact my costs.

Duty and tax assessments for DTH drill bits hinge on factors like their classification, material composition, country of origin, and relevant trade agreements. These elements determine tariff rates and possible exemptions.

Product Classification

Let me tell you, the first time I had to deal with the Harmonized System (HS) code5 for DTH drill bits, it felt like deciphering a foreign language. This code determines the duty rate, and trust me, getting it right is crucial to avoid those pesky penalties. I remember double-checking every entry to ensure accuracy.

Material Composition

Once, I found myself in a bit of a bind when we discovered that DTH drill bits made from tungsten carbide were attracting higher tariffs than expected. It was a learning curve; high-grade steel and tungsten carbide can really affect duty rates. Knowing your materials inside out helps predict these costs.

| Material Type | Potential Tariff Rate |

|---|---|

| High-grade Steel | Moderate |

| Tungsten Carbide | Higher |

Country of Origin

There was this one time when a favorable trade agreement saved us a significant chunk of change. The country of manufacture plays a big role due to trade agreements6. It's always worth checking if your bits benefit from reduced tariffs or exemptions.

Applicable Trade Agreements

Trade agreements7 can be a real lifesaver, reducing or even eliminating duties. I make it a point to review these agreements regularly to see if my imports qualify for any concessions.

Import Documentation

I've learned the hard way that complete documentation is non-negotiable. Missing documents like a commercial invoice or a certificate of origin can lead to frustrating delays and extra costs. I've become quite the document detective over the years!

- Commercial Invoice

- Bill of Lading

- Certificate of Origin

- Packing List

- Import License (if required)

The absence or inaccuracy of these documents can lead to delays and increased costs.

Customs Valuation

Customs valuations can sometimes seem like a black box. They include the cost of goods, insurance, and freight (CIF). Understanding how customs calculate values8 has been key in ensuring compliance.

Inspection and Compliance

I remember once holding my breath during an inspection of our DTH drill bits shipment. Customs checks ensure everything matches the declarations. While nerve-wracking, it's essential for verifying compliance with local standards, and discrepancies can seriously hike up costs.

HS code affects duty rates for DTH drill bits.True

The HS code classification determines the applicable duty rate.

All DTH drill bits have the same tariff rate.False

Tariff rates vary based on material composition and country of origin.

Why do DTH drill bits often undergo customs inspections?

Ever wondered why DTH drill bits get so much attention at customs? Let's dive into the reasons behind those inspections.

DTH drill bits often face customs inspections due to their specific tariff classifications, potential dual-use in military applications, and stringent documentation requirements like certificates of origin and quality assurance.

Classification and Tariff Codes

You know that moment when you're packing for a trip and you realize you haven't checked the luggage size requirements? Well, importing DTH drill bits can feel a bit like that. They fall under specific tariff codes9 that can greatly influence whether they sail through customs or get caught up. These codes determine duty rates and any trade agreements that might apply.

| Tariff Code | Description | Duty Rate |

|---|---|---|

| 8207.19 | Rock drilling or earth boring tools | Varies by region |

Every country has its own rules about duty rates, which means getting these classifications right is crucial to avoid delays or extra charges.

Potential Dual-Use Concerns

Sometimes, those DTH drill bits raise eyebrows at customs because they're like the Swiss army knives of the drilling world—they're powerful and versatile, which means they could potentially be used for military purposes. That's why customs officials might take a closer look to ensure everything's above board. Knowing the export control regulations and having all the necessary permits can smooth out the process significantly.

Documentation Requirements

I’ve learned the hard way that missing even one piece of paper can turn a simple import into a week-long headache. Importing these drill bits requires meticulous documentation. Without everything in order—like a certificate of origin10 or quality certificates—customs delays are almost guaranteed.

Common Required Documents:

- Commercial Invoice: Details transaction specifics.

- Packing List: Lists all items within the shipment.

- Bill of Lading: Contract between shipper and carrier.

Getting these documents right from the get-go can save a ton of hassle.

Compliance with Local Standards

Each country has its own unique standards for DTH drill bits. A failure to comply or lacking ISO certification might lead to more than just a raised eyebrow—it could mean a full-blown inspection. Working with customs brokers who know local regulations can be a lifesaver, helping navigate these complex waters smoothly. Hiring experts11 can prevent those potential compliance pitfalls.

Risk Management and Inspections

Customs inspections are sometimes just a roll of the dice. They're part of risk management strategies where factors like the origin of the goods, the importer's history, and compliance record come into play. I've found that regularly reviewing and updating compliance practices is key to being prepared for these inspections, ensuring that business operations remain uninterrupted.

DTH drill bits are classified under tariff code 8207.19.True

They are categorized for rock drilling or earth boring tools.

Missing a commercial invoice won't delay customs clearance.False

A commercial invoice is crucial for detailing transaction specifics.

How Can I Smoothly Navigate the Payment of Duties and Taxes?

Ever feel overwhelmed by the labyrinth of duties and taxes when importing goods? Let me share how I've navigated this maze with ease.

To ensure smooth payment of duties and taxes, I meticulously prepare accurate documentation, declare goods upon arrival, assess duties correctly, handle customs inspections efficiently, pay dues promptly, and coordinate swift release of goods. This approach minimizes delays and keeps costs in check.

Documentation Preparation

I remember the first time I had to tackle customs documentation—it felt like trying to solve a jigsaw puzzle without seeing the picture. Now, I've learned that having all my ducks in a row with the paperwork is key. I always start with a Commercial Invoice to detail every transaction aspect, from what I'm importing to its total value. The Bill of Lading acts as both my contract and receipt, while the Packing List gives a clear rundown of what's inside each shipment. Sometimes, an Import License is required, depending on the goods and destination. To keep everything in check, I rely on a trusty checklist to ensure I've covered all bases before the shipment even leaves.

| Document Type | Purpose |

|---|---|

| Commercial Invoice | Details transaction specifics |

| Bill of Lading | Serves as contract and receipt |

| Packing List | Lists shipment contents |

| Import License | Required for certain goods in specific countries |

Arrival and Declaration

When my goods arrive, declaring them promptly to customs is crucial. These days, I often do this electronically—thank goodness for technology! Partnering with a customs broker12 has been a game-changer for me. They help navigate local regulations with ease, making sure compliance is never an issue.

Duty and Tax Assessment

Understanding how duties and taxes are assessed was a steep learning curve. It’s all about knowing the goods’ value and classification under the local customs tariff system. Misclassification can lead to unnecessary charges, so I use online tools or consult experts for tariff classification13 guidance. This step can save a lot in unexpected costs.

Customs Inspection

Customs inspections can be nerve-wracking, but I prepare by ensuring all my documents match the shipment contents perfectly. Regularly reviewing my compliance processes with compliance standards14 has helped minimize inspection delays.

Payment of Duties and Taxes

Paying assessed duties promptly is non-negotiable for me. Delays can hold up my goods unnecessarily. Exploring deferred payment options has helped manage cash flow efficiently—something worth looking into if your region offers deferred payment schemes15.

Release of Goods

Once everything’s settled, I ensure goods are released without a hitch. Having a system to track payment confirmations and coordinate logistics immediately after clearance is essential. Setting up alerts for payment confirmation16 keeps things running smoothly and gets my goods delivered without delay.

Accurate documentation prevents customs delays.True

Ensuring all documents are complete and accurate prevents processing delays.

Customs brokers complicate the declaration process.False

Customs brokers streamline the process, ensuring compliance with regulations.

How Can I Speed Up the Customs Clearance for My DTH Drill Bits?

Have you ever felt like customs was a maze with no clear exit? Trust me, I’ve been there too.

To speed up the customs clearance of DTH drill bits, focus on getting your documentation spot on, team up with savvy customs brokers, and stay on top of local regulations. These steps can significantly cut down on delays and make the release process smoother.

Navigating the Paperwork Maze

Remember the first time I tried to import DTH drill bits? I thought I had all the paperwork in order, but a missing detail on the commercial invoice cost me precious time. Here's what I've learned since then:

Accuracy here is not just helpful—it's essential. A tiny slip can lead to big hold-ups.

| Document Type | Description |

|---|---|

| Commercial Invoice | Details the transaction, product description, and terms of sale. |

| Bill of Lading | Serves as a contract and receipt of goods. |

| Packing List | Specifies the contents of each package. |

| Certificate of Origin | Indicates where the goods were manufactured. |

| Import License | Required for certain goods in some countries. |

Missteps in documentation can lead to significant delays, hence precision is key.

Partnering with the Pros: Customs Brokers

Once, after yet another delay, a friend recommended a great customs broker who turned out to be a lifesaver. These folks really know their stuff, from handling complex declaration processes17 to ensuring compliance with local rules. Their expertise has helped me avoid so many headaches and unexpected snags.

Decoding Local Regulations

Staying updated on local customs regulations might seem daunting, but it’s vital. I once got caught off guard by a new regulation in a country I’d been shipping to for years. Now, regular updates from customs authorities or consulting services keep me in the loop and prepared for any changes that could slow down my shipments.

Streamlining Duty and Tax Payments

I can’t stress enough how crucial it is to make duty and tax payments promptly. Registering for deferred payment options has been a game-changer for me, simplifying transactions and speeding up the clearance process. Plus, understanding trade agreements18 has occasionally saved me from extra duty costs.

Reducing Inspection Delays

Customs inspections are a bit like an unpredictable storm; you can't always avoid them, but you can be prepared. By maintaining accurate documentation and complying with local standards, I’ve managed to dodge quite a few inspections. Over time, building a reputation for compliance has also reduced how often my shipments get flagged.

By staying proactive in these areas, I've significantly reduced delays in getting my DTH drill bits released from customs. This not only keeps my operations running smoothly but also keeps my customers happy—and there's nothing more rewarding than that.

Commercial invoices detail terms of sale.True

Commercial invoices include transaction details and terms of sale.

Customs brokers guarantee zero delays.False

Brokers reduce delays but can't guarantee their elimination.

Conclusion

The import customs clearance process for DTH drill bits involves document preparation, duty assessment, potential inspections, and timely payment to ensure smooth release from customs.

-

Understanding current customs regulations ensures compliance and smooth clearance of imported machinery like DTH drill bits. ↩

-

A customs broker can navigate complex regulations, ensuring hassle-free importation of industrial equipment. ↩

-

Learn about essential certifications to ensure your shipment meets US regulatory standards. ↩

-

Explore how DTH drill bits enhance efficiency and precision in mining projects. ↩

-

Understanding the correct HS code ensures compliance and correct duty assessment. ↩

-

Identifying favorable trade agreements can lead to reduced tariff rates. ↩

-

Identifying favorable trade agreements can lead to reduced tariff rates. ↩

-

Learning about customs valuation helps in accurate tax estimation. ↩

-

Understanding tariff codes helps in avoiding unnecessary duty charges and ensures proper classification during import. ↩

-

Certificates of origin verify the manufacturing location, crucial for fulfilling trade agreements and ensuring compliance. ↩

-

Customs brokers simplify the import process by managing documentation, ensuring compliance with local regulations. ↩

-

Understand how customs brokers facilitate smoother transactions by handling documentation and compliance, easing the importation process. ↩

-

Accurate tariff classification helps in determining correct duty rates, impacting overall costs. ↩

-

Adhering to compliance standards prevents delays and ensures smoother customs clearance. ↩

-

Deferred payment schemes can enhance cash flow management by delaying duty payments. ↩

-

Tracking systems help ensure quick follow-up actions post-payment, accelerating goods release. ↩

-

Explore how customs brokers can streamline the clearance process and handle complex documentation efficiently. ↩

-

Learn how specific trade agreements can lower import duties and expedite customs clearance. ↩